Few Americans are able to afford the cost of higher education without some sort of non-familial financial assistance.

Americans currently owe nearly $1.75 trillion in student loan debt, which is $412 billion more than all outstanding automobile loan debt.

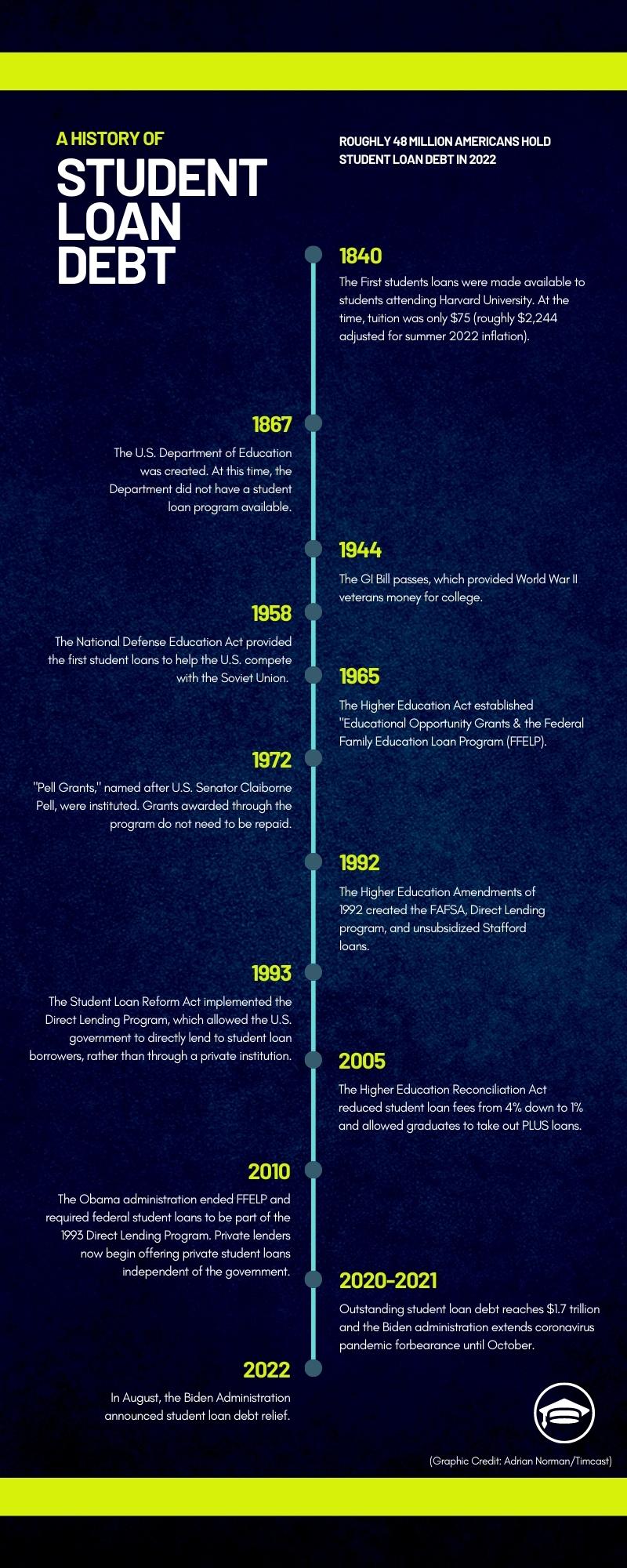

The nature of tuition costs and education subsidies have evolved throughout the years with the origins of student loan financing in the United States going back to the mid 19th century.

We are also able to observe certain milestones at which changes in legislative policy produced measurable effects and increases in the cost of higher education.

1840

The first student loans in the U.S. were offered in 1840 to students who attended Harvard University. The cost of tuition that year was only $75, which in July 2022 dollars would be $2,244.52.

For the 2022-2023 academic year, Harvard tuition for full-time students is $54,768.

1867

The U.S. Department of Education was created in 1867 to collect information on schools and teaching to help states create effective school systems. At this time, there was no government student loan program.

The Education Department grew and changed forms multiple times over the years, increasing the scope of its responsibilities.

In 1980, Congress established it as a Cabinet level agency.

(Graphic Credit: Adrian Norman/Timcast)

1944

The Serviceman’s Readjustment Act of 1944, also known as the G.I. Bill, was a bipartisan effort that helped WWII veterans get free (or cheap) money for college. Benefits included low-cost mortgages, a full year of compensation, tuition and living expenses for high school or college, and low-interest loans to start a business or farm.

Though the benefits were used by 7.8 million veterans, structural barriers were erected to prevent black veterans from being able to access benefits provided though the G.I. Bill.

Southern Democrats feared returning black veterans would leverage support for veterans to advocate against Jim Crow laws, so Democrats used tactics they previously employed with the New Deal to ensure the G.I. Bill helped as few blacks as possible.

1958

Federal student loans were offered through that National Defense Education Act (NDEA) after the Soviet Union’s launch of its Sputnik satellite in 1957 sparked fears that education in the U.S. was inferior to that in the USSR.

The NDEA came at a time when the U.S. faced a shortage of scientists as it became a political priority to establish the power and technological dominance of the U.S. over its adversaries.

The bill authorized funding for four years, and more than a billion dollars was spent on students in science.

1965

The Higher Education Act of 1965 (HEA) was a part of Lyndon B. Johnson’s Great Society agenda. It increased funding for universities, created scholarships, established a National Teachers Corps and provided low-interest loans to students.

It also established the Federal Family Education Loan Program (FFLEP), under which private lenders funded students with government-subsidized loans.

1972

Pell grants were instituted in 1972, named after U.S. Senator Claiborne Pell who sought to reform HEA. To be eligible, students must be a U.S. citizen, pursuing undergraduate studies, have a high school diploma or GED or be able to gain advantage from the program, and have an Economic Family Contribution (EFC) below a certain threshold.

This grant does not need to be repaid. Since its inception, the Pell Grant program has helped more than 80 million students.

1992

The Higher Education Amendments of 1992 created the Free Application for Federal Student Aid (FAFSA) form, which determined a prospective student’s eligibility for financial aid.

It also established the Direct Lending Program and Stafford Loans, which meant that students — rather than the government — now had to pay for interest costs of their student loans. Interest rates on Stafford Loans vary based on education level and the date the loan disburses.

This legislation marked the dawn of America’s “modern-day” student loan system.

1993

The Student Loan Reform Act of 1993 allowed the government to directly lend to students, which, as the Bill Clinton White House stated, made repayment easier, reduced costs for taxpayers by using federal money, and provided lower interest rates.

Both 1992 and 1993 correlate with the first time the cost of higher education began increasing at a higher rate than overall U.S. inflation.

2005

The Higher Education Reconciliation Act of 2005 was signed into law by President George Bush the following year. It provided for the restructuring and consolidation of student loans.

It also increased loan limits for subsidized loans, allowing students to borrow more.

2005 marked another year when the U.S. saw a sharper increase in the cost of higher education compared to overall inflation.

2010

The FFELP program ended under the Obama administration, in 2010, when the Health Care and Education Reconciliation Act was passed, which ended a program that subsidized banks and financial institutions for issuing student loans and allowed students to borrow directly from the federal government.

In 2010, average outstanding student loan debt was $749 billion.

2020-2021

The Coronavirus Aid, Relief and Economic Security (CARES) Act — passed March 2020 in response to the COVID-19 pandemic — reduced interest rates to zero on student loans and suspended payments for a period of six months.

Upon taking office in 2021, the Biden administration extended the forbearance program through October of that year. But, on Aug. 6, the Education Department extended the policy through early 2022.

In 2021, student loan debt was $1.7 trillion.

2022

In late August 2022, the Biden administration announced its plan to cancel student loan debt. Eligible borrowers would be individuals with annual income during the pandemic of less than $125,000 or $250,000 for married couples/heads of households.

Depending on criteria, borrowers are eligible to have either $10,000 or $20,000 forgiven.

The plan also reduces the monthly payment amount from 10 percent of the outstanding balance to five percent.

Outstanding student loan debt in Aug. 2022 stands at $1.75 trillion.